Introduction

For this assignment, I have opted for investigation six concerning comparing job offers. Employment is often considered one of the most crucial aspects affecting one’s financial situation. The primary reasons most individuals work are independence, community, and earning money. After acquiring an education, one is ready to join the workforce. The problem in this case is selecting the job offer that presents as the best alternative. Numerous factors affect one’s salary, including the fringe benefits offered by a company to its employees. Fringe benefits refer to any additional remuneration one may receive from a company besides salary, wage, and commission. The benefits include bonuses, retirement contributions, and health insurance, which immensely increase a job offer’s value. For instance, given the increased cost of medical treatment, a job that offers health insurance saves employees hundreds of dollars. An individual should also consider work incentives and advancement opportunities offered by a job.

While the above factors are extremely crucial when comparing job offers, this paper primarily focuses on the gross salary, tax rate, benefits, cost of leaving, cost of living, and other costs related to three job offers. The primary expectation is that the comparison between current employment in Silicon Valley and two other lucrative job offers in Seattle and Austin will provide the best job opportunity. Given that monthly living expenses currently average about six thousand dollars and as a similar lifestyle will be maintained irrespective of location, it is crucial to consider the job offer that presents the best financial incentives. Such will entail calculating the money left after reduction and monthly expenditure. The benefits that could be accrued over the five years of employment and the cost of terminating the current job should also be considered.

Using Mathematics

The plan for determining the best offer is ascertain the financial implications of each offer. This can be solely achieved by calculating the variance between gross and net income should be considered. Gross income refers to the total income earned by an individual or firm over a given period. Contrarily, net income refers to the income accumulated excluding taxes and other deductions. For individuals, gross income refers to the total income earned in cash, allowances, pension, funds, dividends, and interests. An individual’s gross income is inclusive of monetary remuneration and non-monetary allowances, which may include pension, tax, and insurance. In the current case, the gross income of each job offer is two hundred and fifty thousand in Silicon Valley, two hundred thousand in Seattle, and a hundred and fifty thousand in Austin.

On the other hand, net income concerns the amount left following reductions from the gross income. In the current context, the net income is defined by the total amount left after taxes and personal monthly expenses. For individuals, the amount may be referred to as ‘take-home income’ or ‘salary in hand.’ The formula for calculating individual net income is:

Net income = Total revenue – Total expenses

An alternative approach to solving the problem would be solely considering the benefits of each offer. However, such would overlook the total costs associated with pursuing a given job offer. For instance, the high cost of living in Silicon Valley and high tax rates may undermine the actual profit gained from the offer, regardless of its high gross salary. Calculating the net income presents the ideal approach to solving the problem because it weighs both the benefits and shortcomings of each job offer.

Calculations

This section primarily focuses on four expenses as they relate to the gross income, including tax rate, cost of living, relocation cost, and cost of leaving.

Tax Rate

One of the key considerations to take into account to determine the actual profit is after-tax income. After-tax income refers to the total income minus total taxes. It is indicative of the disposable income one may spend. The after-tax income is used by corporations to accurately project cash flows because it accurately depicts the actual amount available for spending. Although calculations for after-tax income are seemingly simple, the tax rate in different regions may vary due to the various types of taxes to be deducted. Typically, taxes affecting individual incomes in the US are state and federal taxes. Such would account for the variance in tax rates between Texas (seven percent), Washington State (twelve percent), and California (thirteen percent).

The formula for after-tax income is:

After-Tax Income = Gross Income – Taxes

In order to determine the after-tax income, a percentage of the projected annual income should be deducted from the gross income. For instance, given that the current position in Silicon Valley, CA has an annual salary of two-hundred and fifty thousand dollars and is taxed at a rate of thirteen percent, taxes would amount to thirty-two thousand and five hundred dollars a year. Therefore, the after-tax income for the job offer would be two hundred and seventeen thousand and five hundred dollars a year. The position in Seattle, WA offers an annual salary of two hundred thousand dollars and is taxed at a rate of twelve percent. Therefore, the taxes would add up to twenty-four hours leading to an after-tax income of $176k. Lastly, the employment opportunity in Austin, TX offer $150k a year and is taxed at a rate of seven percent. As such, taxes will amount to $10.5k, which would result in an after-tax income of $139.5k. Based on the after-tax income, Silicon Valley, CA is the ideal job opportunity, followed closely by Seattle, WA and Austin, TX, respectively.

However, to determine the actual financial impact of each offer, other expenses should be deducted from the after-tax income, including the cost of living.

Cost of Living

One of the key factors that should inform any decision concerning a job offer is the cost of living in a given region. The cost of living refers to total expenses, including transportation, housing, and food, among other daily expenses. It varies dramatically between cities, especially those presented in the current scenario. The cost of living is often higher in major metropolitan areas compared to other regions. As such, the cost of living immensely affects the spending power of every dollar earned. In the current scenario, the cost of living in different cities is based on percentage in relation to the national average. In Silicon Valley, CA the cost of living is 60% above the national average. It is also 40% and 20% above the national average in Seattle, WA and Austin, TX, respectively.

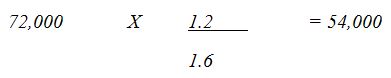

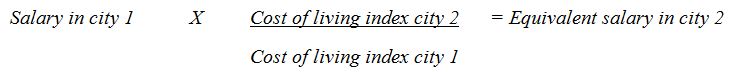

The equation for comparing the cost of living in two cities is:

Therefore, given that the cost-of-living index in Silicon Valley, CA is $72k ($6k per month), the formula should help determine the equivalent salary in other relevant cities.

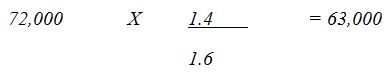

The calculation in appendix one demonstrate the cost of maintaining the current spending of six thousand per month in Austin, TX and Seattle, WA. The first equation suggests that someone spending six thousand dollars a month in Silicon Valley, CA, would have to spend $5,250 per month to maintain the same lifestyle in Seattle, WA. Similarly, the second equation suggests that the same individual would have to spend $4,500 per month in Austin, TX. Therefore, Austin’s salary has a much greater spending power than Seattle’s. Seattle’s salary spending power is also significantly higher compared to that of Silicon Valley. However, before making any decision concerning which job offer is ideal, one should also consider the after-tax salary. While Austin, TX, offers the most salary spending power, it also offers the least after-tax salary. Moreover, one should consider the relocation costs associated with the decision.

Relocation Costs

One of the key concerns when comparing job offers is the cost of relocating to a new city. While the new opportunities in Austin, TX and Seattle, WA, offer a slightly higher salary spending power, the one-time expenses associated with moving to the cities should not be overlooked. Before making the move to either Seattle or Austin, one should do their due diligence concerning moving expenses. For instance, the estimated cost of a single person moving from Silicon Valley, CA to Austin, TX is $6,325 – $8,991 and from Silicon Valley, CA to Seattle, WA, is $5,088 – $7,206 in professional moving expenses. The cost is further aggravated by the cost of selling a home or breaking a lease, purchasing a new home or putting down a security deposit, or moving a vehicle, pets, and family. However, it would be helpful if the employer can financially support the relocation or partially or fully reimburse the relocation costs. Given that the relocation costs do not matter in the case of Silicon Valley, CA, the primary focus would be on Austin, TX and Seattle, WA. In Seattle, WA, the employer will cater for relocation costs up to four percent of one’s salary ($8,000). Therefore, the move would be entirely reimbursed by the employer. During the move to Austin, TX, the employer will only compensate $3,000 in relocation costs, barely covering half of the relocation cost.

Solution and Recommendation

In the above section, this paper has offered insights into the practical application of mathematics in a hypothetical situation concerning weighing different job offers. Based on the calculations, the ideal job offer would be remaining in the current position in Silicon Valley, CA. I am confident that based on the above calculations, Silicon Valley offers the best financial opportunities of the three offers. This is because the findings suggest that while Silicon Valley has the highest deductibles the high gross income offered compensates for any financial strain an employee may experience. Although an alternative method would solely seek the financial benefits of each offer, it would arrive at the same solution. Besides having the highest tax rates and lowest salary spending power, Silicon Valley has the best renumeration and benefits package.

Although the other offers have more favourable tax rates and salary spending power, the current position offers the best ‘take-home income.’ For instance, despite having the highest tax rate, Silicon Valley, CA, has the highest after-tax income of the three job offers. Additionally, although Austin, TX and Seattle, WA, demonstrated a lower cost of living and, subsequently, higher salary spending power, the high salary offered in Silicon Valley, CA, easily compensates for the high cost of living. For instance, the salary of $250k offered in Silicon Valley, CA, is equivalent to $218,750 in Seattle, WA and $187,500 in Austin, TX. Lastly, the current position has no relocation costs.

Appendix One

The equation below would determine the equivalent salary in Seattle, WA:

The equation for the cost of living in Austin, TX would be: