Introduction

College fee is at an all-time high in America, and this cost keeps rising. Some parents worry that they may not be able to afford to take their child to college. Others question whether going to college is worth the high costs. However, with a proper savings plan, it is possible to be financially prepared for college. Parents often wonder when to start saving for college and how to do this. As will be discussed, it is best to start saving for a child’s college tuition as early as possible.

Why Save for College

Parents should save for their child’s college education for various reasons. It prepares them for the time their child will be of college-age. Putting money aside ensures that when the time comes, the parents will have an easier time paying for the fees. Additionally, college costs are very high and continue to rise every year. Therefore, it is wise to save for it and be prepared. Saving for college also minimizes or completely eliminates the need for a person to take out a student loan. Consequently, this gives them an advantage as they are able to start adult life without massive debts.

How to Save for College

There are a number of ways to save for a child’s college education. Firstly, one can open a 529 plan, which is a tax-advantaged saving or investment account. This money can later be withdrawn and used to pay for college. Second, the parent can open a custodial account where they operate the account on behalf of the child until they are of legal age. Third, they can use a savings bond, which is a long-term debt given to the government in exchange for periodic payments and a lump sum at maturity of the bond. Other savings or investment plans include mutual funds, education savings accounts, and life assurance policies. Each savings or investment strategy utilizes a different plan that has pros and cons. Therefore, parents should investigate which strategy works best depending on their financial standing.

When to Save for College

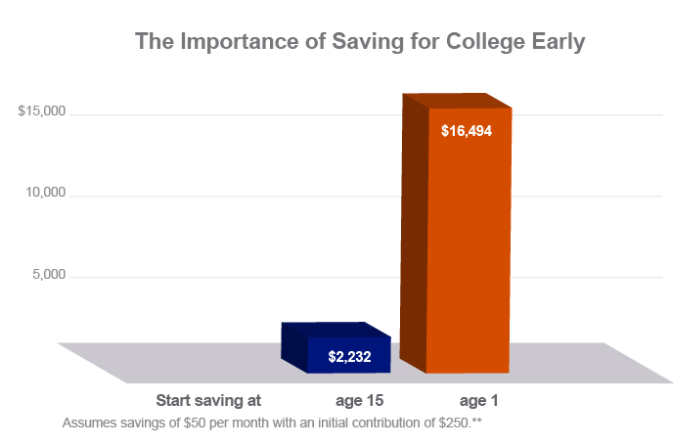

Many parents know that they should save for their child’s education. However, a lot of them wonder when the right time is to start making such an investment. It is prudent to begin saving for a child’s college education as soon as possible. For some parents, this means saving even before the child is born. They make a decision on whether or not to have a child based on if they can afford to pay for their college education. Other parents start to save when the child is born and others when they reach their teenage years. The bottom line is that the earlier the parents can start saving, the better it is for both them and the child.

Why Start Early

It is essential for parents to start saving early for their child’s college education. This gives adequate time for personal and financial planning. When you start late, you may not have as much flexibility as you would like. Starting early also benefits one through interests gained. When you deposit money, it starts to accumulate interest. Interest in investment is an incentive to save early for a child’s college education. It also results in more money being saved since the interest is added to the principle. Finally, saving early allows one to deposit small amounts of money over a long period of time and builds a good saving habit.

Conclusion

The cost of a college education is high in the country. Without a proper plan, parents and their children may find this period difficult. Therefore, it is advisable for parents to save or invest money for this purpose. They should start early to reap the benefits of long-term savings and investments. Starting early also breeds a good saving culture that can be sustained over a long time. Guardians should research and decide the best savings scheme for them. Saving is helpful for the parents as well as the child, and the former should strive to save for the well-being of the whole family.

References

Kirby, C. (2017). Should you save for college using a 529 prepaid tuition plan? Wisebread. Web.

Williams, G. (2020). 8 ways to save for your child’s college education. US News. Web.