Introduction

Student loans have been part of the American education system for many years and have enabled millions of students to acquire higher education. Repaying student loans has, however not been easy as many students expected, especially in the last decade. Harsh economic times have plunged the globe and caused financial difficulties that have made it difficult for graduates to repay their loans. The most recent event to have complicated the issue is the COVID-19 pandemic which harmed global economies to extreme levels. Graduates were unable to attend to their economic activities owing to the various restrictions, therefore incapable of meeting their student loan repayment targets. This research paper provides a breakdown of the student loans challenge in the US. A section of this paper suggests the repayment of a certain percentage of the student loans by the government as a solution to the challenge. Sufficient evidence is provided to rationalize the reasoning behind reducing the burden for this crucial part of the American and global population. The benefits of reducing the burden challenge for students are analyzed.

Explanation of the Problem

Student loans are offered by various governments across the globe to both college and university students to enable them to fund higher education. The loans are crucial in the payment of tuition fees and other needs for these students, albeit personal desires. The repayment of student loans upon graduation and employment has, however, been an existential challenge for these students. Many graduates have defaulted these payments, and this presents difficulties for them when seeking various government opportunities and services. Student loans repayment is expected to start upon graduation of students who may not have acquired employment during that period. While trying to make sense of the corporate space, students are required to start remitting a huge percentage of their earnings to the loaning bodies. During this period, students usually have made minimal strides in securing their own lives and meeting their basic needs, including shelter, food, and clothing. The students have massive responsibilities in their homes, especially if there is a huge number of dependents. All their earnings are required to meet a certain expense, and the repayment of student loans is not a priority.

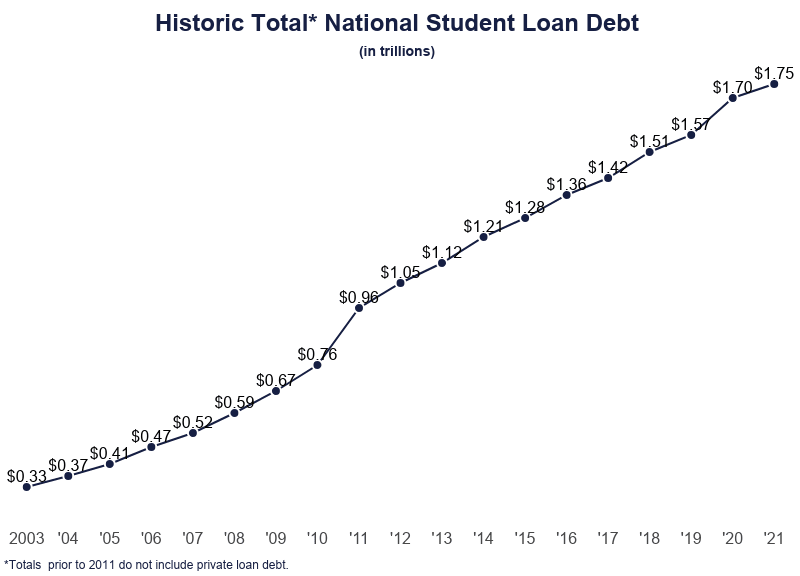

Student loan defaults are immense in America, given the difficulty associated with meeting these demands. Reports indicate that at the end of 2021, one-tenth of the American people had defaulted on a student loan (Hanson). At any given time, 15% of student loans are defaulted, and 11% of graduates default in the first 12 months of repayment. $124.4 billion in student loans have defaulted and this prevents massive figures in the American economy (Hanson). There has been a steady rise in the number of student loan beneficiaries in America, with large amounts being owed as shown in appendix 1 (Hanson). The high number of beneficiaries is directly proportional to the number of defaulters and Americans unable to service these loans.

Student loans are currently more difficult to pay compared to the last few decades, given the shift in American politics and the economy. Securing a job immediately after graduation is now more challenging, and many graduates must wait on the sidelines compared to the past when jobs were easier to get. The challenge of inflation and rising costs of living make it difficult for students to repay the loans procured during their higher learning process. The recent challenge of the COVID-19 pandemic made it difficult for American graduates to secure jobs and meet their various needs. Geopolitical issues such as the war between Russia and Ukraine have caused inflation and economic difficulties in the US, making loan repayments difficult.

Explanation of the Solution

The solution to tackling student loans in America lies in ensuring the government meets a certain percentage of these loans, effectively reducing the burden for graduates. Reducing the student loans for students is both realistic and achievable, given the massive relief it guarantees to avail the American economy. The process of reducing student loans requires the input of policy-makers in Congress first, duly elected by the people. The government should employ the services of competent data investigation to ensure the number of students affected by the data repayment melee is established. The number can then be analyzed through various lenses, including the reasons for reduced repayment and the challenges faced by the American people. Objective surveys on the appropriate amount the government can repay loans for its people without becoming dysfunctional should be conducted.

Upon establishment of the amounts and reasons, Congress should draft a bill that seeks to compel the national treasury to reduce the student loans. The process must be put through vigorous public participation to ensure the American citizens provide their input on the matter. Upon debate in Congress, the members of the house can agree to pass the bill into law so that student loans can be minimized. The next step is ensuring the president ascends this bill into law and directs the national treasury to make payments of loans for various students. The law can be adopted in all states of the USA to ensure students and graduates everywhere benefit. This is bound to reduce the burden on fresh graduates, enabling them to create wealth and boost the American economy.

Evidence in Support of the Solution

The change in leadership at the helm of the US government was crucial in enabling the nation to realize the possibilities around the forgiveness of student loans. President Biden’s administration promised to handle the student debt pandemic, citing the difficulty debts pose to students trying to progress in life. As of 2021, the government had canceled over $11 billion in federal student credit (Eaton et al.). The cancellation of debt for these students was total and considered different parameters, including their location and financial ability. Their year of employment and income were also crucial parameters in identifying the graduates deserving of this opportunity.

The cancellation of debt enabled these citizens to procure employment faster, with the baggage eliminated from their profile. Graduates were additionally empowered to become more productive members of society, remitting taxes to the government (Miller et al.). The approach of partly forgiving student debt has been a common feature in many European countries in the recent past. This tactic has been vital in reengineering economic advancement in these countries and tackling stagnation. Student debt cancellation has been employed partly in Germany and Britain, reducing the debt burden.

This research paper proposes an approach that borrows from the benefits accrued from the cancellation of debt in the USA. This research paper suggests that instead of canceling debt totally for some people in the country, the benefit can be spread to a greater population. This entails forgiving a certain percentage of debt for most, if not all, citizens with the debt burden. This approach guarantees a widespread ripple effect within the entire nation, fostering belief and encouraging hard work. The reduction of the amount of debt for most students should effectively lower the amount of household income that goes into ensuring repayment. The additional capital can ensure that families can acquire other crucial necessities, including housing. The initiative to reduce student debt must be wary of the potentially catastrophic effect this action may have on the economy.

Massive repayment of the student loans by the government might cause massive inflation, weakening the American dollar globally. This approach may also reduce the amount of money in circulation, causing reduced flow and reducing business operations (Goldrick-Rab and Steinbaum). The process of repaying debts in part must therefore occur on the back of massive research, which guarantees the nobility of this action is not overshadowed by the potential harm to the American economy. The repayment can occur over time to ensure the impacts are not felt at once and the economy is given sufficient time to recover.

Benefits of the Solution

Reducing student debt could reduce the unemployment rate in the US, ensuring more people can procure and maintain jobs. The increased number of employed people can ensure the nation enjoys a greater gross domestic product, increasing earnings. This will create a broader tax base for the nation, ensuring the greater ability of the government to spearhead the development and revolutionize the lives of Americans for the better (Maggio et al.). Reducing the burden will also act as an integral method of reducing the racial wealth gap in the country. People of color within the country comprise the minority groups whose ability to accrue wealth is limited. Reducing student loans guarantees that these people are enabled to actualize their potential and raise their ability to generate wealth (Charron-Chenier et al.). This will ensure that racial disparity and inequality within the nation are addressed in all sectors, with the changes being spearheaded by the reduced student debts.

The reduction in student loans is also likely to ensure students can start their lives on a debt-free platform. This implies that graduates do not make loan repayment their priority but instead focus on essential aspects such as meeting other basic needs (Maggio et al.). These needs include shelter and supporting their relatives in meeting various requirements, including education. “Additionally, we should forgive a minimum of $10,000/person of federal student loans, as proposed by Senator Warren and colleagues. Young people and other student debt holders bore the brunt of the last crisis. It shouldn’t happen again…” (Biden). In the statement above, the current US president acknowledges the damage debts had on students and young people during the COVID-19 pandemic. He suggests paying part of their debt to ensure their lives are better and the American economy improves.

Conclusion

In conclusion, reducing the number of debt students and graduates pay to the government will benefit both their personal lives and the economy in general. Reducing this debt is within the abilities of the government, given the funds at its disposal and the goodwill of the legislative arm in general. These decisions are crucial in ensuring lives are bettered, the GDP increased, and racial inequality addressed. Reducing student debt is an overdue act by the government, and these massive financial burdens have been, in part, responsible for some stagnation witnessed within the country. Reducing student debt is a far more realistic option compared to canceling them completely. Total cancellation is likely to cause inflation, damaging the ability of the USA to compete within the global economic space. The reduction of debts should be gradual and calculative to prevent negative repercussions likely to result from hasty action.

Works Cited

Biden, Joe. “Student debt.” Twitter, 2020. Web.

Charron-Chenier, Raphaël, et al. Student debt forgiveness options: Implications for policy and racial equity. 2020.Web.

Eaton, Charlie, et al. “Student debt cancellation is progressive: Correcting empirical and conceptual errors.” Papers.ssrn.com, 2021.Web.

Goldrick-Rab, Sara, and Marshall Steinbaum. What is the problem with student debt? 2020.Web.

Hanson, Melanie. “National student loan default rate [2021]: Delinquency Data.” EducationData, 2021. Web.

—. “Student loan debt statistics [2022]: Average + Total Debt.” EducationData, 2022, educationdata.org/student-loan-debt-statistics.Web.

Maggio, Marco Di, et al. “Second chance: Life without student debt.” National Bureau of Economic Research, 2019.Web.

Miller, Ben, et al. “Addressing the $1.5 trillion in federal student loan debt.” Vtechworks.lib.vt.edu, 2019.Web.

Appendix 1